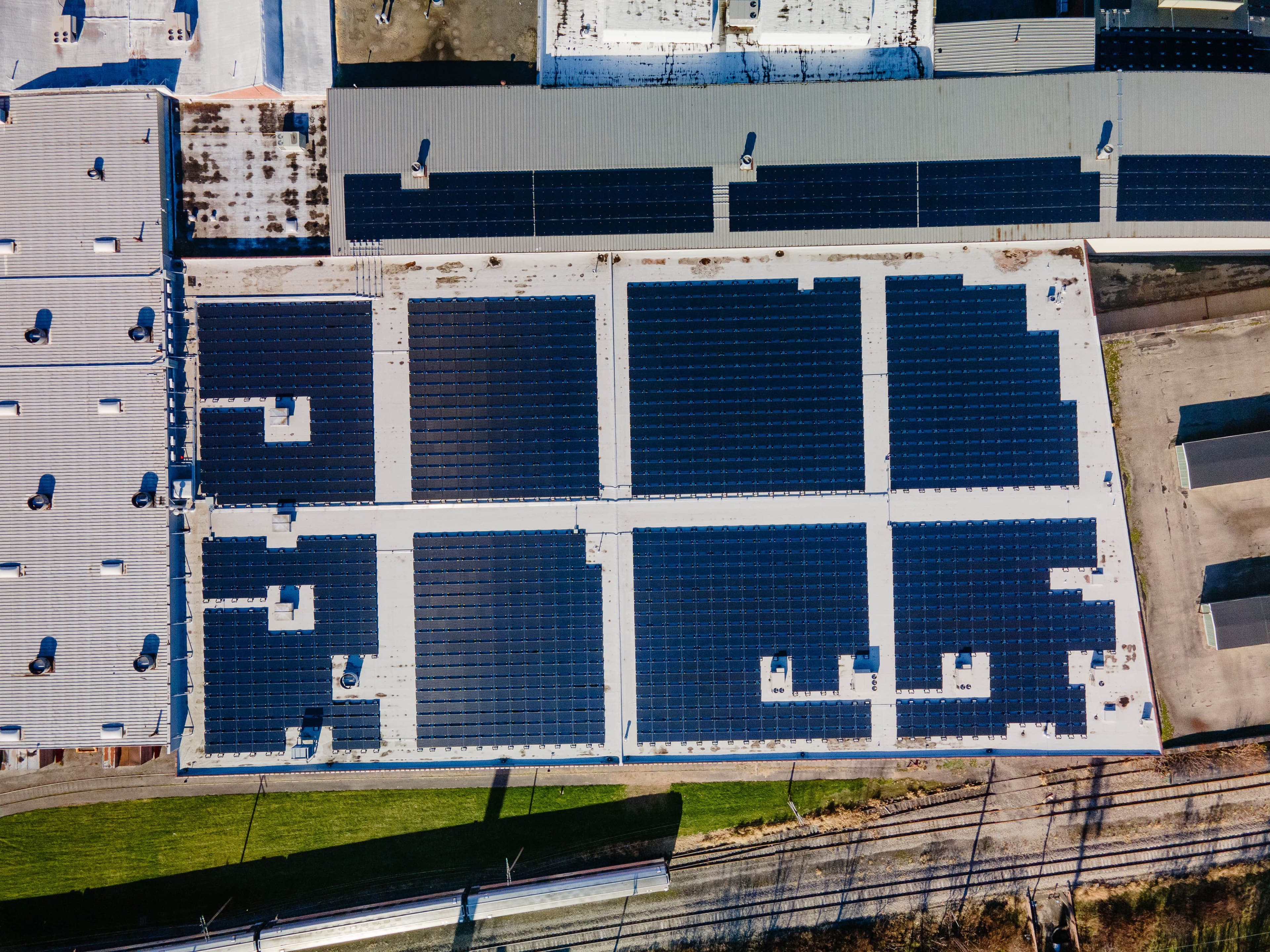

Why Rising Electricity Rates Are Making Commercial Solar More Profitable in 2026

As energy costs continue to rise across the United States, businesses and institutions are finding that commercial solar energy is delivering stronger financial returns than ever before. Recent industry data shows that increasing retail electricity prices are significantly shortening the payback period for commercial solar systems, reinforcing the value of investing in renewable energy today.

Escalating Utility Costs Boost Solar Economics

According to a Wood Mackenzie analysis reported by pv magazine USA, rising retail electricity rates are becoming a primary driver of commercial solar adoption. The analysis finds that if average annual electricity price growth accelerates from 2% to 6% between 2026 and 2050, the typical payback period for a commercial solar system drops from 6.3 years to just 4.2 years — a 33% reduction in payback time. This shorter payback is driven by the greater value of reducing high utility expenses with on-site solar generation.

This shift in economics is especially meaningful for businesses, nonprofits, and institutions that operate on tight budgets and are sensitive to fluctuations in energy costs.

Commercial Solar Keeps Growing Despite Market Headwinds

The commercial solar sector has shown impressive growth even as other segments face headwinds. In 2024, the non-residential solar market added 2,118 MW of capacity, setting a new annual record. While some distributed solar segments contracted earlier in 2025, commercial solar installations continued to expand, showing 4% growth in the first quarter and 27% in the second quarter of 2025.

These figures highlight not only the resilience of the commercial solar market but also its increasing appeal as an investment that counters rising utility costs.

Regional Differences Matter — And New York Is Well-Positioned

The Wood Mackenzie analysis also reveals that payback periods vary widely across the country, with a roughly 12-year gap between the best and worst state markets. States with higher retail electricity prices — like California, Hawaii, Massachusetts, Connecticut, and New York — consistently show shorter payback periods and strong commercial solar deployment.

For organizations in New York and across the Northeast, this means solar installations can deliver stronger financial performance compared to other regions where retail electricity costs remain lower.

Why This Matters for Businesses & Institutions

As federal solar incentives evolve and grid power becomes more expensive, the value of generating electricity on-site continues to grow. Commercial solar offers:

- Faster return on investment as utility bills rise

- Protection against future energy price volatility

- Improved long-term operating forecasts

- Demonstrated sustainability and community leadership

At Buffalo Solar, we help businesses, organizations, and institutions understand how market trends and rising utility costs affect their solar investment strategy.

Ready to explore how commercial solar can save your organization money while enhancing sustainability? Contact us today for a customized solar assessment.

Also, follow us on Instagram and LinkedIn for the latest commercial solar insights, project highlights, and clean energy updates!